The Investment Management team assesses market conditions, pinpoints opportunities, and aims to execute thoughtful strategies with the goal of realizing results for our investors.

Units under managment

Total transaction volume

Assets under management

We invest together, we apply our platform to the investment and seek to consistently produce strong returns. Led by a blend of experienced professionals across disciplines and industries, we seek to stay closer to the deal without outsourcing the process to create early efficiencies.

Our fully integrated platform aims to align top-of-funnel deal-sourcing activity with strong, daily investment management and backend investment realization expertise. Our ability to assist in active management as soon as LOI acceptance can help produce strong performance at acquisition. With a fully integrated platform and a structured process, we seek to create efficiencies where others may not be able.

We leverage a vast network of personal relationships with ownership groups and brokers, a strong transaction history of more than 250 acquisitions and dispositions in the past 10 years, and a wealth of underwriting data in our proprietary database as we seek to identify and acquire what we feel are the best deals. Our ability to source investments others may not recognize has served our partners well in strategic capital deployment to date.

Our platform and team experience helps us pursue multiple – and even divergent – strategies when the market requires. Our core/core+ strategy targets investments in stabilized assets located in what we feel are defensible markets with predictable cash flow. While our value-add experience sources investment opportunities in assets with potential for increased value by making physical and operational improvements. In addition to current market analysis, we use technology and data from our own portfolio to forecast trends that influence our investment decisions and market focus.

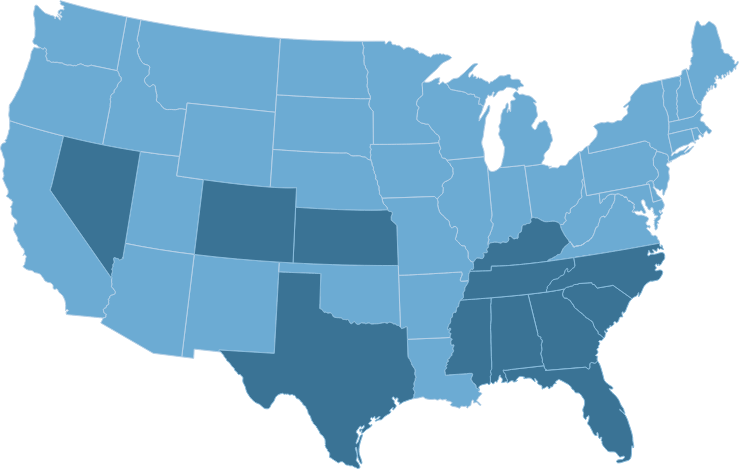

Since inception, we have sought to maintain a nimble investment approach. We have the ability to adapt our investment strategy to take advantage of current conditions. We were an early mover in suburban Sun Belt multifamily, and made a $2B bet on workforce housing starting in early 2017. View our national portfolio.

Our fully integrated platform aims to align top-of-funnel deal-sourcing activity with strong, daily investment management and backend investment realization expertise. Our ability to assist in active management as soon as LOI acceptance can help produce strong performance at acquisition. With a fully integrated platform and a structured process, we seek to create efficiencies where others may not be able.

The National Real Estate Investment Firm’s First Disposition of 2022 Includes 321 Units in Texas

Learn MOre

Let’s start the conversation.

Send us a message and someone will get back to you shortly.